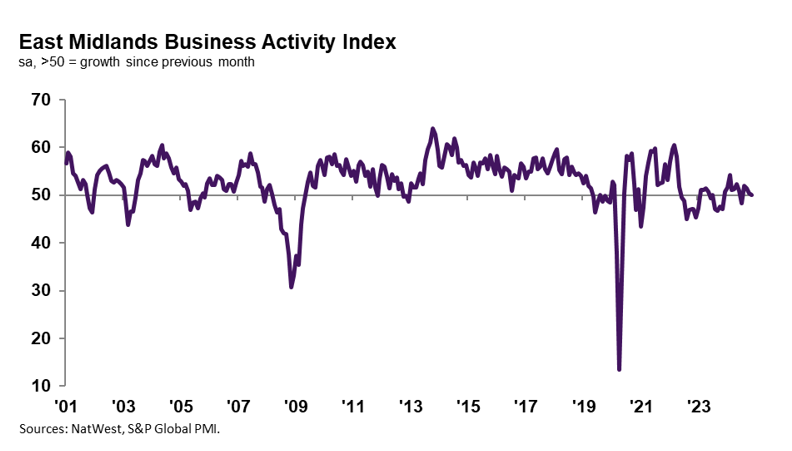

Latest Regional Growth Tracker survey data from NatWest signalled only a slight upturn in business activity across the East Midlands private sector in November.

The headline NatWest East Midlands Business Activity Index dropped to 50.1 in November, down from 50.4 at the start of the fourth quarter. The latest data indicated a broad stagnation in output across the region’s private sector, with the headline figure well below the series average.

Growth in output was linked by firms to orders for specialised products and stockbuilding. Weighing on the expansion, however, was economic uncertainty which dampened customer demand, according to panellists.

East Midlands firms indicated a further contraction in employment midway through the fourth quarter. Although companies noted that planned redundancies and cost management solutions drove the decline in workforce numbers, the pace of decrease was only fractional.

Average cost burdens increased at a steeper rate during November. Moreover, the rate of inflation was the joint-fastest since July (equal with September). Despite subdued demand conditions, East Midlands businesses increased their selling prices again. Output charge inflation was reportedly driven by the pass-through of higher costs to customers.

Lisa Phillips, Regional Managing Director, Midlands and East, Commercial Mid Markets, said: “East Midlands firms signalled sustained efforts to expand business activity in November, despite demand conditions weakening.

“Efforts to support output and hopes of growth in activity in the coming year led to a much slower pace of decline in employment. Moreover, the pace of job shedding was the softest in 2024 so far.

“Encouragingly, firms were able to raise their selling prices again, and at a solid pace. Although margins were squeezed by a faster uptick in costs while output charges increased at a softer rate, companies were able to partially pass-through higher input prices to customers.”

Performance in relation to UK

Of the 12 monitored UK regions and areas, only six signalled a Business Activity Index reading above 50.0 in November. Of these six, the East Midlands recorded the slowest upturn. Nevertheless, the UK average only indicated a marginal expansion in output at the national level.

November data indicated a second successive monthly fall in new orders at East Midlands firms. The pace of decline quickened to the fastest since June, but was only marginal overall. Anecdotal evidence suggested that the decrease in new business was due to weaker domestic and foreign client demand, and economic uncertainty.

The fall in new orders contrasted with the UK average, with only Wales and Northern Ireland recording sharper declines.

Nonetheless, East Midlands companies continued to anticipate an increase in output over the coming year in November. Panellists hope for stronger demand conditions over the next 12 months, although the degree of confidence dipped to the lowest in 2024 to date.

As has been the case since October 2022, East Midlands firms recorded a decrease in backlogs of work in November. The pace of decline quickened to the joint-fastest since September 2023 (alongside June 2024). That said, the rate of job shedding was the slowest in 11 months and weaker than the UK average.

Meanwhile, the pace of input cost inflation was quicker than the UK average, as companies noted that greater input prices were due to higher material, wage and utility costs.

The rise in selling prices was slower than the series average and the UK trend, however.