Manufacturing output volumes fell at the fastest pace since mid-2020 in the quarter to December, according to the CBI’s latest Industrial Trends Survey (ITS). Manufacturers expect another steep drop in output over the next three months.

Total and export order books deteriorated sharply relative to last month, with the volume of total orders falling to its weakest since late 2020. Against a backdrop of weak demand, manufacturers’ stocks of finished goods remain relatively high, at levels last seen during the early stages of the Covid pandemic.

Meanwhile, expectations for selling price inflation picked up noticeably in December, with the rate of selling price inflation during the next three months expected to be comfortably above the long-run average.

The survey, based on the responses of 331 manufacturers, found:

- Output volumes fell in the three months to December (weighted balance of -25%, from -12% in the quarter to November), the steepest decline since August 2020. Manufacturers expect output to fall again in the quarter to March 2025 (-31%), with expectations weaker than at any time since May 2020.

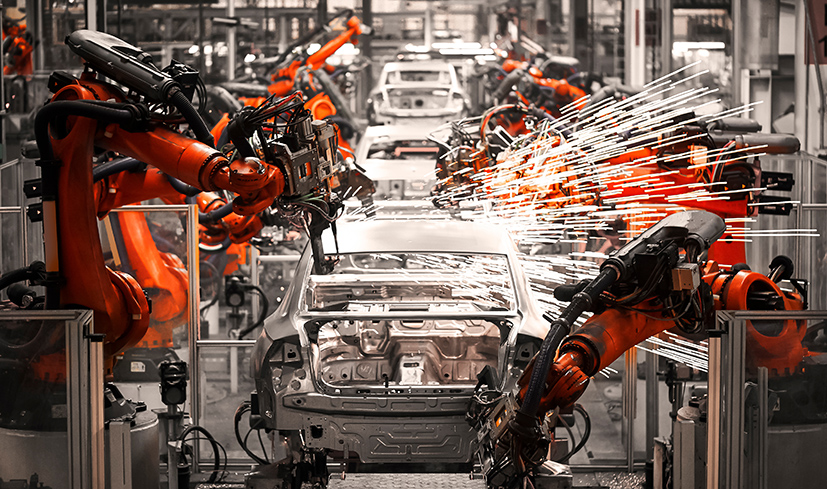

- Output decreased in 15 out of 17 sub-sectors in the three months to December, with the significant fall driven by the furniture & upholstery, glass & ceramics and motor vehicles & transport equipment sub-sectors.

- Total order books were reported as below “normal” and deteriorated markedly relative to November (-40% from -19%). The level of order books in December was the weakest since November 2020 (and far below the long run average of -13%).

- Export order books were also below “normal” in December (-37% from -27% last month). This was also below the long-run average (-18%).

- Expectations for average selling price inflation picked up in the quarter to December (+23% from +11% in November), with the balance of manufacturers expecting prices in the quarter ahead to rise above the long-run average (+7%).

- Stocks of finished goods were reported as more than “adequate” in December and to a similar extent as in November (+20% from +21%), which was the highest reading since August 2020. Stock adequacy stands well above the long-run average (+12%).

Ben Jones, CBI Lead Economist, said: “Manufacturing output appears to have contracted during the fourth quarter, with conditions across the sector looking more challenging than at any time since the Covid pandemic in 2020.

“Manufacturers are facing a perfect storm of weakening external demand on the one hand, amid political instability in some key European markets and uncertainty over US trade policy. And on the other hand, domestic business confidence has collapsed in the wake of the Budget, which has increased costs and led to widespread reports of project cancellations and falling orders.

“Manufacturers are heading into 2025 with no expectation of any near-term improvement. As firms continue to work through the challenges of the Budget, the Government could help support business confidence by accelerating measures that could restore some headroom for investment, such as delivering flexibility to the Apprenticeship Levy or signalling a faster timetable to reform business rates.

“And working in full partnership with boardrooms to develop a long-term industrial strategy would send the right signals to the markets and investors that the UK is a trusted and competitive destination to do business.”