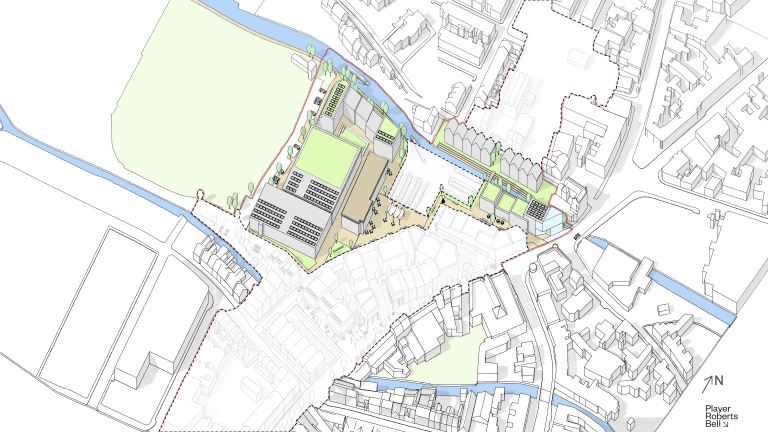

- Redevelop the Priory Centre including the development of a brand-new leisure facility focused on family-orientated activities such as tenpin bowling, an indoor soft play facility, a trampoline park and a café. The redevelopment will retain existing occupiers and bring in new tenants for current empty units.

- Deliver a new green footpath/towpath link along the Chesterfield Canal along with new moorings, capitalising on canal boat traffic whilst improving a green corridor through the town centre.

- Create a footbridge over the Chesterfield Canal resulting in improved connectivity to the main town centre from the residential areas to the north of the town which is one of the most deprived areas within Bassetlaw.

- Enable the redevelopment of the area for new town centre living, bringing two sites forward for development and encouraging underutilised space to be made into apartments and town houses.

- Create a multi-functional market area with a new food court.

- Create a new cycle hub that includes a cafe with changing facilities and bike lockers.

- Improve the existing road surfacing to ensure there is defined access into the Shopping Centre.

Worksop Town Centre set for £20m investment

£3m Sherwood Observatory funding confirmed

New directors appointed to Marketing Nottingham board

Derby law firm props up commercial property team with quadruple promotion

Lincoln-based Environmental Marketing Company planning expansion secures £15k funding

Transformational £14.8m government grant backs Boston regeneration vision

More than £18.4m Levelling Up funds awarded to Cleethorpes

East Lindsey District Council to make Horncastle its HQ as it opens shared facility with Boston College

£8m secured to transform at-risk heritage and cultural sites in East Lindsey

Three historic sites are set to benefit from £8m Levelling Up funding from the Government.

£20m Levelling Up funding secured for South Holland

Record year for East Midlands private equity-backed buyouts

Ibstock sees resilient final quarter

Dunelm reports strong second quarter

Homewares retailer, Dunelm, has reported a “strong performance” in its second quarter.

According to an update on trading for the 13-week period ended 31 December 2022, total sales of £478m were 18% higher than the same period last year and up 48% compared to three years ago, pre-pandemic.

Dunelm says this performance reflects a strong quarter in which Autumn and Winter product ranges proved particularly popular with customers. The company saw broad based growth across its categories and its Christmas offer sold well. Customers seeking ways to mitigate higher heating costs also found value in Dunelm’s ‘Winter Warm’ assortment, as well as in products such as heated indoor airers.

The Leicestershire firm expects full year profit before tax to be above current market expectations.Nick Wilkinson, Chief Executive Officer, said: “We have delivered another strong performance and the relevance of Dunelm’s value offering has really come to the fore. Customers have enjoyed shopping our ‘Winter Warm’ ranges as they find innovative ways to manage rising heating costs. Our Christmas assortment also proved popular as customers prepared their homes for the festive period.

“It is a difficult time for many people in our communities, so we were delighted to significantly grow our ‘delivering joy’ campaign this year, resulting in over 60,000 Christmas gifts being donated by customers and colleagues to local causes.

“We are deeply conscious of the challenges which everyone is facing and remain focussed on making every pound count across our entire offer, so customers can feel confident in receiving outstanding value whatever their budget or taste.”

Operational issues at distribution centre see Dr. Martens predict EBITDA dip

Derby tech business attains B Corp status

Orderly, a technology business based in Derby with a focus on artificial intelligence to boost supply chain social responsibility and sustainability, has achieved the coveted B Corp certification.

Orderly now join the ranks of over 4,000 companies who are using business as a force for good.

The B Corp was established in 2006 and is the first and only certification for businesses that meet the highest standards of social and environmental performance, public transparency, and legal accountability.

To become B Corp Certified, a business must complete an in-depth assessment administered by the non-profit B Lab.

Orderly staff had to fill out a lengthy assessment (over 200 questions) that looked at every aspect of the business – from its environmental impact, to how the company treats its employees, to the diversity of the team.

This was followed by a phone review by B Lab staff to clarify points, while requests were then made for documentation of key points.

Orderly CEO Peter Evans, said: “When we heard about B Corp Certification, it felt like the perfect fit. It’s taken us almost three years of incremental change to gain the certification and has been a huge team effort. Getting certified is certainly a challenge – but well worth it.”

This is just the start, added Peter: “Becoming B Corp Certified is just the beginning. By stipulating that companies must ‘set improvement goals against the most-up-to-date standards and benchmark their performance over time’ that ensures that we are constantly striving to improve and be the best that we can be – which of course, every business should be.

“We have big plans for the future including developing our world-first digital store assistant technology, and we are excited to continue our journey as a sustainable and ethical business – with that exciting new B Corp Certified logo joining us for the ride.”