British Business Bank’s second annual Nations and Region Tracker records the use of external finance falls in the East Midlands region

£6.5m National Stone Centre takes step forward as plans submitted

Work starts to build student village energy and data hub at Loughborough University

Manufacturer unveils multi-million-pound heat pump production line at Belper factory

Midlands real estate investment levels ahead of 10-year average

Direct investment into real estate assets in the Midlands is running well-ahead of the 10-year average for deal value, according to a new study.

The findings, from property services firm JLL, report that the total amount of capital invested in the East Midlands was up 13 per cent to £1.1bn and four per cent in the West Midlands to £1.5bn over the first nine months of 2022.

Nationally, deal values for UK real estate assets reached their highest levels since before the Brexit referendum this year owing to a strong first six months, but volumes have tapered as economic worries set in.

JLL found that that £40.4bn of capital was spent acquiring real estate over the first nine months of 2022.

Although this total is the highest since 2015, £29bn of this came during the first six months of the year with quarter three volumes down 13 per cent on the same period in 2021 and eight per cent below the third quarter 10-year average.

More than half (52 per cent) of asset purchasers over the first nine months of the year were based overseas, with Asia-Pacific (16 per cent) and the Americas (15 per cent) the regions accounting for the largest shares. Both regions invested more in the UK than their 10-year averages (12 per cent each).

On a country-by-country level, the US (£5.4bn), Singapore (£1.9bn) and Australia (£1.9bn) were the top individual investors by value.

Across the UK, offices accounted for the largest share of investment volumes at 37 per cent of all deals in the third quarter of this year (£15.1bn), with the living and industrial sectors both accounting for more than a fifth (21 per cent each).

Ben Kelly, director of capital markets at JLL in Birmingham, said: “The Midlands has always had a significant appeal with both UK and international real estate investors. Several key events this year have helped boost its standing, from the Commonwealth Games to the arrival of Goldman Sachs. Meanwhile, the market dynamics, especially in the region’s traditionally strong sectors like industrial, continue to drive attractive returns.”

Cameron Ramsey, UK research and strategy at JLL, added: “As our Transparency Index revealed earlier this year, the UK boasts several cities that are regarded as world leaders for transparency on data, regulations, and performance benchmarks for international investors, with Birmingham 10th globally.

“This foundation means major institutional investors, which have long-term horizons, will always consider UK real estate investment as an essential part of their portfolios.”

The Autumn Statement, perhaps it should have come with a health warning? By James Pinchbeck, partner, Streets Chartered Accountants

PDS snaps up 50,000 sq ft warehouse facility

Plans submitted for 136-hectare sustainable urban extension transforming Skegness

Reserved Matters approval for 75 new homes in Calow

Bioscience space proposed for The Island Quarter

Record revenues expected at Van Elle following strong first half

“Robust” trading and new CEO for Forterra

Neil has almost three decades’ experience in the building materials sector and an impressive track record of improving performance and delivering growth. Currently at Etex, the Belgian lightweight building materials manufacturer, he leads the Building Performance division which is a €2 billion revenue business. During his time at Etex Neil oversaw major capex projects, significant acquisitions, and developed its sales approach which delivered strong top line growth.

His experience includes 15 years at Lafarge, where he undertook many roles, including the role of Vice President International Business Development and Sales and Commercial Director UK & Ireland of Lafarge Plasterboard.

Justin Atkinson, chairman, said: “We are very pleased to appoint Neil as the next CEO. His business leadership and extensive building materials sector knowledge will be invaluable to Forterra in the next stages of our development and the Board looks forward to working with him.

“The Board and I are grateful to Stephen Harrison for the significant contribution he has made to the business during his tenure as CEO. We wish him all the best for the future after he leaves Forterra in the second quarter of 2023.”

The news comes as Forterra provides an update for the ten-month period ended 31 October 2022, in which trading “has remained robust” with YTD sales volumes in line with last year. The firm says this reflects ongoing production capacity constraints and record low inventory levels. Group revenue in the period was 23% ahead of the prior year, driven by selling price increases. Full year results are expected to be in line with management’s expectations.Stephen Harrison, CEO, said: “Trading remains robust although we are watchful of the impact of the recent instability in financial markets and the reported negative impact this is currently having on the housing market.

“The group enters this uncertain time in a position of strength having a strong balance sheet with low levels of debt and high levels of cash generation. Inventories remain at record low levels and despite the current uncertainties we remain well-placed to mitigate the effects of a softening of demand by substituting imported bricks with domestically manufactured product.”

Eden PR adds new Account Manager to growing team

East Midlands Chamber urges region’s businesses to get involved with devolution consultation

Honorary professorship for Leicestershire business leader

Another successful year for the East Midlands Expo

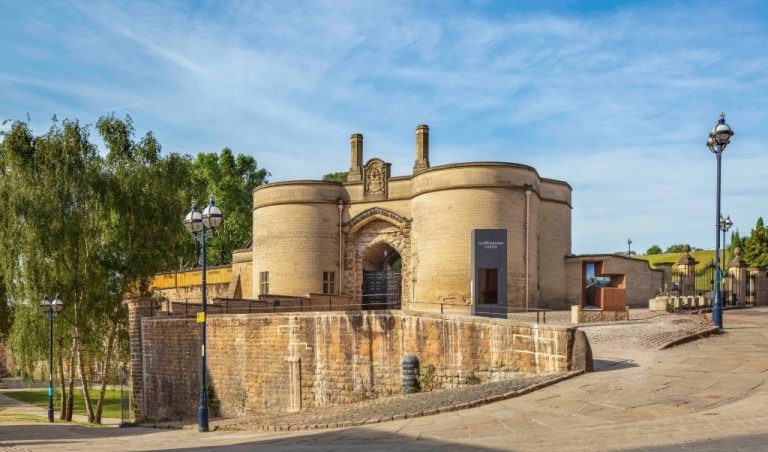

Nottingham Castle closes to visitors as Trust begins process of appointing liquidators

Wilko enters talks for £30m loan

Mobility products manufacturer secures J28 warehouse unit

Commercial Property Partners (CPP) has let a 64,002 sq ft modern warehouse facility at The Nursery in South Normanton to Pride Mobility UK Limited.

The US company, the designer and manufacturer of mobility products, recently acquired the Nottinghamshire-based rise/reclining chair manufacturer Sitting Pretty with a view to relocating its whole operation to accommodate future expansion plans.

Unit 2, which forms part of The Nursery industrial scheme, offered Pride Mobility three times the space of the previous manufacturing site, with circa 85 staff relocating to the new base, which also enjoys easy access to Jct 28 of the M1, only one mile away.

Built in 2006, Unit 2 is a detached steel portal frame unit with 10m clear working height, four dock level loading doors, two level access loading doors, a two storey open plan office with canteen and welfare facilities. Externally, the unit boasts a 40m concrete, fenced and gated yard and circa 80 parking spaces.

Wincobank Way forms part of the South Normanton industrial estate, an established commercial location which has attracted numerous key occupiers including Eurocell, Alloga UK, Radius Systems and GXO Logistics. Road connectivity and access to a local skilled labour market also help to underpin the location as a sought-after manufacturing and logistical base.

Sean Bremner, director at CPP, said: “Staff retention was a key requirement for the tenant and so finding a solution within relative close proximity to their existing premises was important. The company is very brand conscious and Unit 2 represents a high quality building to fit the profile of Pride Mobility UK Limited.

“There was a lot of interest in the facility and we’re delighted to have secured Pride Mobility UK Limited whose expansion ambitions can only be good for the area.”

Stephen Wright, operation director at Pride Mobility UK, said: “Thanks to Sean Bremner, CPP & the owners of the Building. We have been able to move into this building much quicker than we expected, which in turn has given us the space we desperately needed due to the business growing rapidly since acquiring Sitting Pretty back in July 2021.

“The new building gives us the space we need to move the whole operation under one roof, including dispatching goods from South Normanton instead of our Pride Mobility subsidiary in Oxfordshire and more importantly being able to keep all of our existing staff and their wealth of experience rather than having to relocate the business to a different area.

“From January 2023, Sitting Pretty by Pride Mobility Ltd will be running its newly polished, full scale operation out of South Normanton for the foreseeable future.”