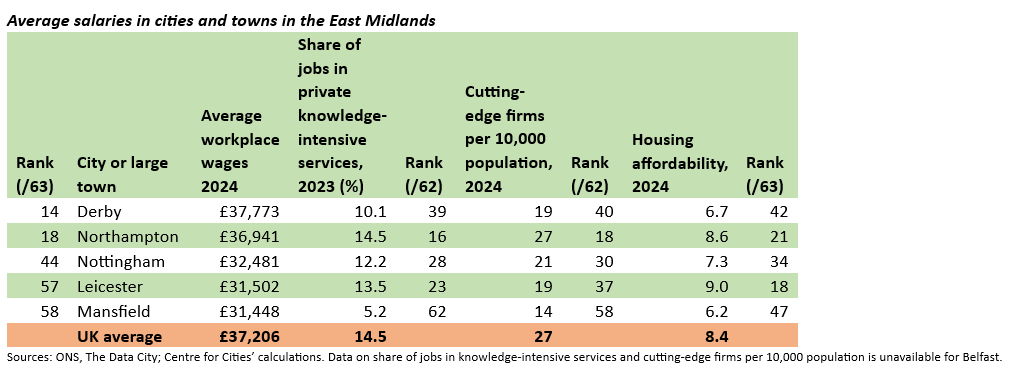

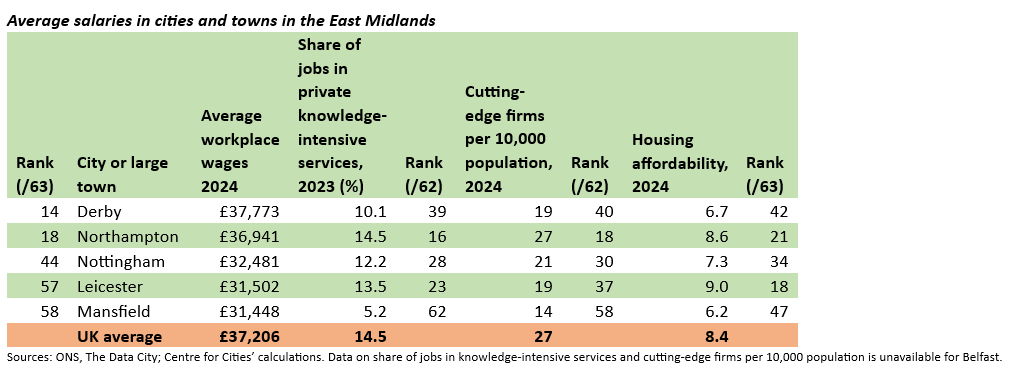

Cities Outlook 2025 today (20 January 2025) shows the stark pay divides in the UK. Average salaries of £49,500 in London are £16,800 above salaries in the East Midlands (£32,700), according to Centre for Cities.

This means that the average worker in London has earned by August what the average worker in the East Midlands will take a year to earn.

The pay divide primarily results from some cities having far more “cutting edge” private sector jobs and businesses than others. Places with the highest pay such as London and Cambridge have more than twice as many cutting-edge firms and up to three times as many cutting-edge jobs – in sectors like biotech and AI – as low pay places such as Leicester and Mansfield.

The scale of the pay divide underlines why 2025 has to be the year the Government delivers on its ambitions to raise economic growth. In Cities Outlook 2025, its latest annual outlook for urban economies in the UK, Centre for Cities urges the Government to follow through on its economic policy programme – including English devolution, the industrial strategy, and planning reforms.

Out of the 63 largest towns and cities, nearly all those with above-average salaries for the UK are in the Greater South East, including Reading and Milton Keynes. Just seven places in the rest of the country have salaries above the UK average – Leeds, Warrington, Derby, Swindon, Bristol, Aberdeen and Edinburgh.

Cities and towns where workplace wages are low have to address the barriers to growth in cutting-edge parts of their economy. This will require evidence-based assessments on the weaknesses in their local economies, prioritising work in high-skill over high-street activity and investing in fundamentals – such as skills, transport and workspace.

Cities Outlook 2025 also emphasises the importance of implementing the proposed changes to the national planning system to make housing delivery easier and quicker.

Lowering housing costs is a challenge for cities and large towns with high wages, including London and most places in the Greater South East: half of the ten places with the highest average wages also rank in the ten least affordable housing markets.

High housing costs eat into disposable incomes and raise barriers that prevent people moving to these areas to take advantage of the economic opportunities they offer.

Andrew Carter, Chief Executive of Centre for Cities, said: “The Government is right to identify boosting economic growth for every part of the country as a top priority. It is the only sustainable route to higher wages. But the stark nature of Cities Outlook’s findings shows an incremental approach is not going to be enough.

“Boldness, urgency and scale are crucial. 2025 needs to be year for delivery, particularly on the Government’s Industrial Strategy, framework for English devolution and its reforms to planning.

“Bold changes to planning rules can deliver more housing in the most expensive places and in our big cities, where it’s needed most. The Industrial Strategy must prioritise growing the cutting edge of the economy, and avoid calls to do something for all sectors and industries.

“And English devolution needs to be fast-tracked so more places, particularly the big cities, have the powers and resources to deliver the pay increases that many parts of the country badly need.

“This government has promised more money in people’s pockets. If people across the country are going to earn more by the end of the parliamentary term, then 2025 is year we need to see action and progress on the Government’s growth ambition.”

Out of the 63 largest towns and cities, nearly all those with above-average salaries for the UK are in the Greater South East, including Reading and Milton Keynes. Just seven places in the rest of the country have salaries above the UK average – Leeds, Warrington, Derby, Swindon, Bristol, Aberdeen and Edinburgh.

Cities and towns where workplace wages are low have to address the barriers to growth in cutting-edge parts of their economy. This will require evidence-based assessments on the weaknesses in their local economies, prioritising work in high-skill over high-street activity and investing in fundamentals – such as skills, transport and workspace.

Cities Outlook 2025 also emphasises the importance of implementing the proposed changes to the national planning system to make housing delivery easier and quicker.

Lowering housing costs is a challenge for cities and large towns with high wages, including London and most places in the Greater South East: half of the ten places with the highest average wages also rank in the ten least affordable housing markets.

High housing costs eat into disposable incomes and raise barriers that prevent people moving to these areas to take advantage of the economic opportunities they offer.

Andrew Carter, Chief Executive of Centre for Cities, said: “The Government is right to identify boosting economic growth for every part of the country as a top priority. It is the only sustainable route to higher wages. But the stark nature of Cities Outlook’s findings shows an incremental approach is not going to be enough.

“Boldness, urgency and scale are crucial. 2025 needs to be year for delivery, particularly on the Government’s Industrial Strategy, framework for English devolution and its reforms to planning.

“Bold changes to planning rules can deliver more housing in the most expensive places and in our big cities, where it’s needed most. The Industrial Strategy must prioritise growing the cutting edge of the economy, and avoid calls to do something for all sectors and industries.

“And English devolution needs to be fast-tracked so more places, particularly the big cities, have the powers and resources to deliver the pay increases that many parts of the country badly need.

“This government has promised more money in people’s pockets. If people across the country are going to earn more by the end of the parliamentary term, then 2025 is year we need to see action and progress on the Government’s growth ambition.”

Out of the 63 largest towns and cities, nearly all those with above-average salaries for the UK are in the Greater South East, including Reading and Milton Keynes. Just seven places in the rest of the country have salaries above the UK average – Leeds, Warrington, Derby, Swindon, Bristol, Aberdeen and Edinburgh.

Cities and towns where workplace wages are low have to address the barriers to growth in cutting-edge parts of their economy. This will require evidence-based assessments on the weaknesses in their local economies, prioritising work in high-skill over high-street activity and investing in fundamentals – such as skills, transport and workspace.

Cities Outlook 2025 also emphasises the importance of implementing the proposed changes to the national planning system to make housing delivery easier and quicker.

Lowering housing costs is a challenge for cities and large towns with high wages, including London and most places in the Greater South East: half of the ten places with the highest average wages also rank in the ten least affordable housing markets.

High housing costs eat into disposable incomes and raise barriers that prevent people moving to these areas to take advantage of the economic opportunities they offer.

Andrew Carter, Chief Executive of Centre for Cities, said: “The Government is right to identify boosting economic growth for every part of the country as a top priority. It is the only sustainable route to higher wages. But the stark nature of Cities Outlook’s findings shows an incremental approach is not going to be enough.

“Boldness, urgency and scale are crucial. 2025 needs to be year for delivery, particularly on the Government’s Industrial Strategy, framework for English devolution and its reforms to planning.

“Bold changes to planning rules can deliver more housing in the most expensive places and in our big cities, where it’s needed most. The Industrial Strategy must prioritise growing the cutting edge of the economy, and avoid calls to do something for all sectors and industries.

“And English devolution needs to be fast-tracked so more places, particularly the big cities, have the powers and resources to deliver the pay increases that many parts of the country badly need.

“This government has promised more money in people’s pockets. If people across the country are going to earn more by the end of the parliamentary term, then 2025 is year we need to see action and progress on the Government’s growth ambition.”