New MD for IMA Architects as senior team step up

Manufacturing network teams up with charity to provide free mental health support

Government develops new planning rules for nuclear development, paving the way for Rolls-Royce SMRs

- Including mini-nuclear power stations in planning rules for the first time – so firms can start building them in the places that need them.

- Scrapping the set list of eight sites – which meant nuclear sites could be built anywhere across England and Wales.

- Removing the expiry date on nuclear planning rules – so projects don’t get timed out and industry can plan for the long term.

- Setting up a Nuclear Regulatory Taskforce – that will spearhead improvements to the regulations to help more companies build here. This will report directly to the PM.

Charity giving ‘happy days’ to 35,000 children a year hails “incredible” two-year support pledge from Derbyshire science company

Sparks of economic recovery as new business numbers rise in East Midlands

Leicester shopping centre snapped up

Streets’ to deliver annual update on issues affecting payroll management, HR and compliance

- NLW and NMW changes and rates for 2025

- Statutory increases

- Working from home expenses

- Working from home when home is in another country

- Changes to the employment allowance

- Employment allowance and connected entities

- Employers NI changes

- What can be done to mitigate the NI increases

- What can we anticipate in the future

- What businesses need to do to demonstrate that they are taking measures to prevent sexual harassment following the amendment to the Equality Act that came in in October 2024 and the guidance issued by Equality and Human Rights Commission

- What will happen with the Government’s Employment Rights Bill in 2025

- Other legislation that will come into force in 2025 that businesses should be aware of

To register for the event click here.

This presentation will be recorded and available on demand for those not able to join live. Simply register to receive a link to watch on demand.Record first half performance for sustainable building products firm Alumasc

Alumasc, the Northamptonshire-headquartered sustainable building products, systems and solutions group, has seen a record first half performance, with revenue and profit on the rise.

According to results for the six months ended 31 December 2024, group revenue increased by 20% to £57.4m, with organic growth in all three divisions.

Underlying profit before tax, meanwhile, grew strongly, up 19% to a record £7.5m.

Statutory profit before tax rose to £6.5m from £5.6m in the same period of the prior year.

Paul Hooper, Chief Executive of Alumasc, said: “We are pleased to report a record first half, driven by both organic and inorganic growth. Group revenue grew by 20% compared to the prior period, which is a particularly impressive result given the challenging market environment.

“All three divisions have demonstrated continued growth in revenue, highlighting the resilience of our business model. This performance reflects execution of, and focus on, our four strategic pillars: accelerating organic revenue growth; enhancing efficiency and margins; advancing sustainable products; and making value-enhancing investments.

“We’ve also made significant progress in expanding our presence in export markets, which should benefit future periods’ revenues and profits. We are particularly excited about the performance of ARP Group, who have exceeded expectations since joining the Group in December 2023. We are confident that we will continue to see synergies and efficiencies come through in the second half.

“We remain confident in both the quality of our businesses and in our capacity to deliver our ambitious growth plans, supported by our strong positions in higher growth sustainability-driven markets, and have a clear line of sight to delivery of significant shareholder value.”

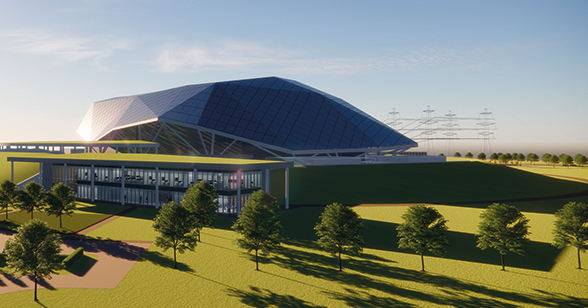

Rolls-Royce welcomes strategic co-operation with Hungary over SMRs

Games Workshop appoints LEGO regional president to board

Games Workshop, the Nottingham-based manufacturer of miniature wargames, has appointed Eric Maugein to the board as non-executive director of the company.

Eric will also become a member of the Audit and Risk, Remuneration and Nomination Committees.

Eric has more than 35 years of experience in the consumer goods sector and spent 20 years of his career at The LEGO Group. Most recently, Eric was regional president at The LEGO Group Asia Pacific.

Eric has considerable experience in building and leading successful strategies for new markets in the Middle East, Europe and Asia, defining and implementing expansions in markets such as China and India.