A deteriorated and ageing shop parade in Mansfield has been torn down to make way for new homes and a green community space.

Shop parade demolished to make way for new homes

Leicester’s WBR Group acquires Censeo

- SSAS and DBSSAS actuarial services

- Full services for ‘smaller’ defined benefit pension schemes (generally fewer than 1,500 members or under £50M in invested assets):

- Pensions administration and treasury

- Scheme actuary services

- Investment consultancy

- Pensions consultancy

- Trustee training

- Funeral plan trusts

- Pensions on divorce

Small business growth forecasts fall for the first time since July 2024

- In London the percentage of small business owners predicting growth has plummeted from 57% to 39% in just three months – presenting a two-year low point in confidence for enterprises in the Capital (since Q2 2023

- The North East was one of the regions that saw a post-election resurgence in small business confidence during the second half of 2025. This quarter, the percentage of North East small business owners that predict growth has fallen sharply back from 36% to 25%.

- A similar picture emerges for the East Midlands, where growth forecasts have fallen from 37% to 31% since last quarter

- Growth forecasts are a serious concern in the South West and Wales, these two regions now falling significantly behind all other UK regions (17% and 16%).

- Scotland bucks the trend prevalent in England. For Q1 2025, the percentage of small business owners predicting growth has hit a five-year high at 36% (the highest figure in Scotland since Q3 2019)

Secretary of State for Work and Pensions visits Workbridge in Northampton

The Secretary of State for Work and Pensions, RT Hon Liz Kendall MP, has been to Northampton to visit people who have been taking part in a mental health social prescribing programme.

Ms Kendall, who has held the ministerial position since July last year, visited Workbridge – the vocational and educational part of mental health charity St Andrew’s Healthcare – to find out more about the Community Skills and Wellbeing programme.

The initiative was developed to help people who have been unable to work due to mental ill health, by easing them back into employment. The visit comes as the Department for Work and Pensions (DWP) has published new research which shows that many sick and disabled people say they want to work to help boost their living standards – but aren’t given the right support.

Work and Pensions Secretary, Rt Hon Liz Kendall MP, said: “Today’s report shows that the broken benefits system is letting down people with mental health conditions who want to work. People claiming Health and Disability benefits have been classed by the system as “can’t work” and shut out of jobs and have been ignored – when they’ve been crying out for support.

“That is a serious failure. It’s bad for people, bad for businesses, which miss out on considerable talent, and bad for the economy. For young people in particular, being out of work can have a scarring effect that lasts a lifetime.

“On Time to Talk day, it’s time to change how we support people with long-term health conditions, such as a mental health condition, so that they have a fair chance and choice to work.”

Prison officer Teresa Hawkins is on long term sickness leave, but would really like to return to work when she feels well enough. The 48-year-old, who has been attending the five-week programme at Workbridge, said: “I’ve been off work for three months now and all I’d been doing was sitting at home, overthinking, which wasn’t doing me any good. My social prescriber gave me a list of courses in Northampton to help get me out of the house and I liked the sound of the artwork course at Workbridge.

“It took a lot of courage for me to walk through the door on the first day – I was very nervous as I didn’t know what to expect, I almost didn’t come – but I’m so glad I did because if I didn’t have this course I would be getting up late every day. It’s helped give my day structure and a reason to get up. The course tutors are so lovely and friendly, I feel like this is a safe place for me.”

The programme was made possible courtesy of a £60,000 grant provided through the central Government’s UK Shared Prosperity Fund (UKSPF) via West Northamptonshire Council (WNC). The programme is part of a wider initiative aimed at enhancing local skills and fostering positive change within the community.

Those who sign up are supported by skilled tutors, helping them to realise their potential. Participants are given the opportunity to learn new skills, understand more about resilience and gain confidence which is hoped will assist them in gaining employment.

Teresa said: “This course has really helped me. I’ve met some like-minded people, learnt some new skills and I don’t feel as hopeless as I used to. I live with my daughter and she’s seen me so low, and it’s always her that picks up the pieces. I desperately want to get better so she can go live her life.

“This programme is helping me to heal and for the first time in a long time, I’ve got hope for my future. I want to go back to work eventually and the people here are helping me as I’m getting back all the social skills that I had lost from being at home all day.”

Dr Sanjith Kamath St Andrew’s Healthcare’s Deputy CEO and Executive Medical Officer, said: “As the largest mental health charity in the UK, we are committed to amplifying the voices of those who have complex mental health needs. We know that stigma around mental health remains a major barrier to people getting the support they need and this can be even worse for those with complex challenges.

“Across the UK more than a million people are waiting for mental health services. Too often, long waiting lists and a lack of early intervention mean that people’s mental health worsens, making it harder for them to stay in or return to work. There is an urgent need for parity of esteem between mental and physical health, so that people receive the right support at the right time. We must act to ensure timely, accessible care for all.

“This vital support from the UK Shared Prosperity Fund (UKSPF) means we’re able to offer courses to those most in need helping people rebuild confidence, gain new skills, and take positive steps toward employment in a welcoming and supportive environment.”

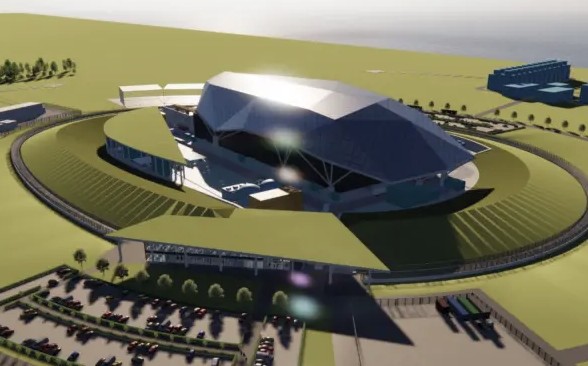

Rolls-Royce says Government’s decision will re-establish the UK as a world leader in nuclear

East Midlands marina to be sold for first time in its history

£1.2m plans revealed for new culinary experience at Retford’s Buttermarket

Innovative legal workflow provider acquired

Litera, a global leader in legal technology for experience management, has acquired Nottingham-based Peppermint Technology, an innovative provider of technology solutions tailored to law firms and a valued Microsoft partner.

This strategic acquisition significantly elevates the value law firms derive from their Microsoft applications, adding innovative marketing, business development, and case & matter management solutions to Litera’s suite of legal technology capabilities that manage the end-to-end legal experience.

Peppermint’s CRM, Client Engagement, allows law firms to create a unified view of the client. This enables more personalised interactions and enhances the targeting of business development activities through data-driven decision-making.

Gary Young, CEO of Peppermint Technology, said: “We are very excited to become part of the Litera family, where our shared vision and offerings will deliver even more benefit to our customers and the wider legal sector.

“It is the right time in Peppermint’s growth journey to bring our businesses together, having similar cultures and ambition for our people, customers, and partners.”

“The combined offerings from Litera and Peppermint Technology will empower law firms to excel in client engagement and operational efficiency directly in the Microsoft tools they use every day,” said Avaneesh Marwaha, CEO of Litera.

“We are excited to both integrate Peppermint’s innovative solutions into our portfolio and partner with Microsoft, accelerating Litera’s mission to transform top-to-bottom the entire legal experience and give our clients efficiencies they did not imagine possible.”

“As mutual customers of both Litera and Peppermint, we are excited about the opportunities this acquisition presents for our lawyers, enabling seamless access to some of our most utilised applications within the cloud,” said Mike Wilson, Managing Partner at law firm Blake Morgan.

“By integrating our legal workflows directly into Microsoft cloud applications, we anticipate a significant boost in efficiency for our lawyers, and Litera and Peppermint have been key partners in achieving this vision. We look forward to continuing our collaboration and are confident that this acquisition further enhances the exceptional products and services we’ve come to expect.”

The corporate team in Gateley’s Nottingham office advised the selling shareholders and management of Peppermint Technology, led by partner and Nottingham head of corporate Victoria Elliott, alongside corporate senior associate Rachael Mitchison, corporate solicitor Joe Girgis, corporate paralegal Elizabeth Cole and graduate solicitor apprentice Charlize-Li Clark. The team were also supported by employment partner Paul Ball and tax partner Bernhard Gilbey. Victoria Elliott said: “We are delighted to have advised our long-standing client Peppermint Technology on its sale to Litera Group. This transaction not only underscores our expertise in the tech sector but also highlights our commitment to supporting successful businesses across the East Midlands and beyond. “The opportunity to be a part of the Litera ecosystem of powerful, user-friendly tools heralds another exciting chapter in our client’s growth journey and together will present a formidable offering to the market.”