9,688ft² industrial unit sold to Trentside Products in Mansfield

Major heritage project unveiled for Leicester’s Grand Hotel

Bulk Materials Handling training returns to the classroom

- Basics of hopper and silo design and function

- Dealing with potential problems

- Discharge aids and interfacing to feeders

- Techniques for reducing product degradation during conveying

- Ways to reduce maintenance, repair and unplanned stoppages to pneumatic conveying equipment

- Explosion Hazards including ATEX Directives

- Online: delivered over 5 morning sessions,

- If you prefer to attend in person, you can now do so for a two day course in Chatham, Kent.

wolfson-enquiries@gre.ac.uk +44 20 8331 8646

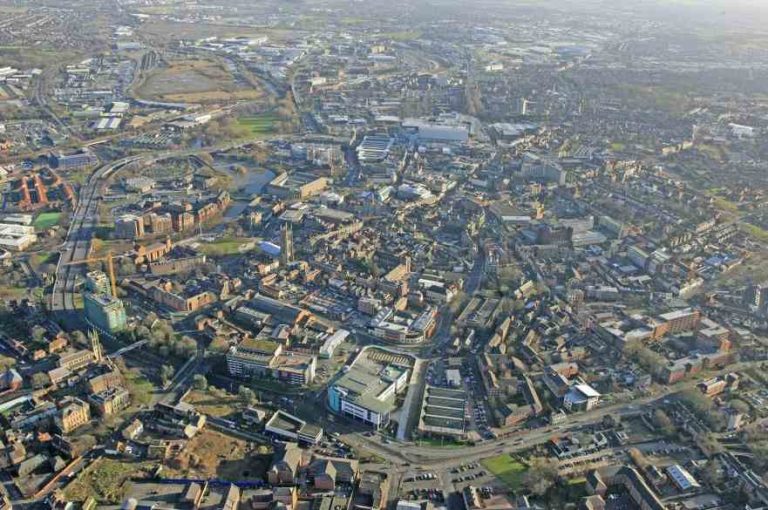

wolfson-enquiries@gre.ac.uk +44 20 8331 8646 First ideas to enhance Derby city centre’s northern gateway revealed

Leicester entrepreneur raises further £1.3m for software platform

Derbyshire company helps restore heritage ‘fairytale cottage’ connected with Florence Nightingale

Breedon hails record year

Rob Wood, Chief Executive Officer, said: “2021 was a record year for Breedon. We navigated the second year of the pandemic successfully, supplied our customers with more materials than at any point in our history and fully integrated the Cemex assets. This excellent outcome was achieved at a time of constant change and the response from our colleagues, adjusting to the pandemic and the volatile economic backdrop, has been outstanding.

“Breedon is maturing. There are strong demand dynamics in our markets and we have many exciting opportunities ahead of us in the current year and beyond. Our GB Surfacing business is positioned for growth, the Cemex acquisition is integrated and poised to reap the benefits of our investment, and we see a number of bolt-on opportunities to in-fill our current footprint in GB and Ireland. Further afield, we have appointed a business development director in the US as we advance our plans for a third platform.

“Breedon has come a long way in the past decade and we have a consistent track record for profitable and cash generative expansion. Our experienced leadership team and committed workforce operate a well-invested portfolio of assets with significant opportunities for sustainable growth. We have a strong balance sheet and will continue to take a measured approach to deploying our capital, taking the time required to find the right businesses to extend our portfolio. The building blocks are in place for our next chapter of growth.”

Ibstock returns to profit

Joe Hudson, Chief Executive Officer of Ibstock plc, said: “Our 2021 results reflect both continued robust demand across our markets and strong operational execution. Despite market-wide challenges arising from cost inflation and supply chain pressure, we have delivered a result ahead of the Board’s expectations, and are well positioned for future growth.

“Whilst we remain mindful of the broader macroeconomic uncertainties, particularly in light of the tragic conflict in Ukraine, we have made a good start to 2022, with a strong demand backdrop. This positive momentum, along with additional brick capacity coming on stream during 2022, provides us with a strong platform to deliver significant further financial and strategic progress.

“Today, we also set out a path for growth and value creation over the next five years, combining expansion of our core business with accelerated diversification into new, fast growing areas of the UK construction market. These strategic ambitions are underpinned by clear financial objectives and capital discipline, which are reflected in the new medium term financial targets. We expect to generate significant additional capital, in excess of our current commitments, over the next five years, which will support both further growth investments and additional shareholder returns.

“With the built environment accounting for around 40 per cent of carbon emissions globally, our industry has a vital role to play in delivering climate change solutions. With our plans to produce the UK’s first net-zero carbon bricks and brick slips well underway, we are supporting our customers in addressing their carbon reduction goals. Having achieved many of the environmental targets set in 2018 several years earlier than expected, we have now announced our new ESG strategic framework and targets, including our commitment to be a net zero carbon business by 2040.”