Manufacturers reported that output volumes rose for the first time since November 2022 in the three months to May, according to the CBI’s latest Industrial Trends Survey (ITS). Manufacturers expect output to rise further in the three months to August, albeit at a modest pace.

Order books remain under pressure, with both total and export order books weakening in May. Manufacturers reported that stocks of finished goods were more than adequate to meet expected demand. Meanwhile, expectations for selling price inflation softened, having picked up earlier in the year.

The survey, based on the responses of 245 manufacturers, found:

- Output volumes rose in the three months to May, having been flat or falling in every month since November 2022 (weighted balance of +14%, from +3% in the three months to April). Output is expected to rise modestly in the three months to August (+7%).

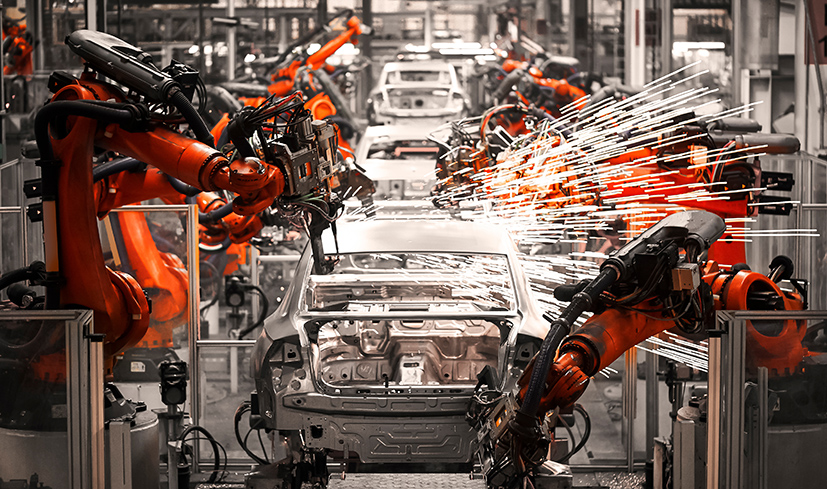

- Output increased in only 8 out of 17 sub-sectors, but this was sufficient to offset flat or falling volumes in the remaining sub-sectors, with the chemicals, food, drink & tobacco and motor vehicles & transport equipment sub-sectors driving overall growth.

- Total order books weakened in the three months to May, with a net balance reporting order books as “below normal” falling to -33% (from -23%). The level of order books therefore remained below the long-run average (-13%).

- Export order books were seen as below normal and deteriorated relative to last month (-27%, from -23%). This was also below the long-run average (-18%).

- Expectations for average selling price inflation softened in May (+15%, from +27% in April), having picked up steadily over the first four months of 2024.

- Stock adequacy for finished goods improved in the three months to May, with the net balance of firms reporting that stocks were “more than adequate” rising to +14% (from -1% in the three months to April), broadly in line with the long-run average.

Anna Leach, CBI Deputy Chief Economist, said: “While it’s positive to see that manufacturers’ expectations for higher output volumes have finally been realised in the three months to May, this has been accompanied by a sharp deterioration in order books to close to their weakest since January 2021.

“Manufacturers expect to increase output through the summer months, but any recovery looks set to be fairly gradual, with order books soft and inventory levels relatively high.

“As the economy is starting to show signs of recovery, now is the time to pursue reforms that will boost growth and investment for manufacturers as well as ensuring the UK’s competitive edge globally.

“The CBI’s latest report ‘Tax and Green Investment’ highlights the role that tax policies should play in incentivising green investment to help drive up to £57 billion annually in additional GDP, sending a strong signal to business that the UK is an attractive place to invest.”