Manufacturing output volumes fell sharply in the three months to September, according to the CBI’s latest Industrial Trends Survey (ITS). Manufacturers expect output to decline again in the three months to December, the first-time expectations have been negative since November 2023.

Both total and export order books deteriorated in September, relative to August, and were reported as well below their long-run averages. Expectations for selling price inflation eased in September, with prices expected to rise at a rate close to the long-run average. Meanwhile, stock adequacy (for finished goods) fell slightly, but remains close to the long-run average.

The survey, based on the responses of 275 manufacturers, found:

- Output volumes fell sharply in the three months to September, following a more modest decline in the quarter to August (weighted balance of -20% from -9% in the three months to August). Looking ahead, output is expected to fall in the three months to December (-7%), the first-time expectations have been negative since November 2023.

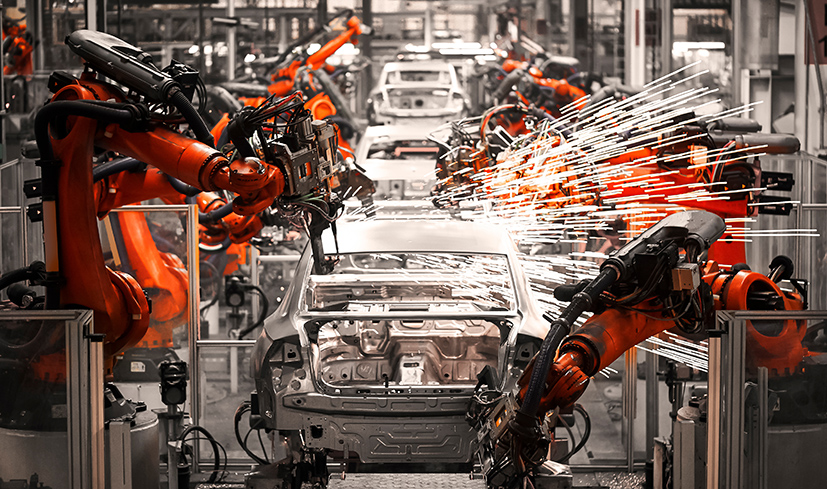

- Output decreased in 14 out of 17 sub-sectors in the three months to September, with the fall driven by the motor vehicles & transport, metal products and paper, printing & media sub-sectors.

- Total order books were reported as below “normal” in September and deteriorated relative to last month (-35% from -22%). The level of order books remained significantly below the long run average (-13%).

- Export order books were also seen as below “normal” and deteriorated considerably relative to last month (-44% from -22%). This was also far below the long-run average (-18%) and left export order books at their weakest since December 2020.

- Expectations for average selling price inflation softened in September (+8% from +15% in August), with the balance standing close to the long-run average (+7%).

- Stocks of finished goods were seen as more than “adequate” in September (+11% from +15% in August), broadly similar to the long-run average (+12%).

Ben Jones, CBI Lead Economist, said: “This was a uniformly disappointing set of results for the manufacturing sector, with output falling over the past quarter, order books deteriorating and manufacturers expecting activity to soften further in the remaining months of the year.

“The survey highlights that the recovery of the UK economy seen over the first half of 2024 remains fragile, with uneven progress seen across different sectors, and businesses increasingly cautious ahead of the Budget at the end of next month.

“In the meantime, firms will be looking to the Chancellor to reaffirm the government’s mission of long-term economic growth, providing them with the confidence and opportunities to invest and grow.

“Whether that’s building on recently announced planning reforms, introducing a Net Zero Investment Plan or reducing costs – for instance through a clearer, fairer and more competitive business rates system, or setting out a business tax roadmap that delivers a simpler, more digitised and proportionate tax system.

“Coupled with a modern, international industrial strategy, the government could take a major stride in delivering the confidence businesses and investors are looking for. This has the potential to supercharge investment and UK growth over the next Budget period and beyond.”