Latest Regional Growth Tracker survey data from NatWest signalled a renewed decline in business activity at the start of 2025 amid subdued demand conditions.

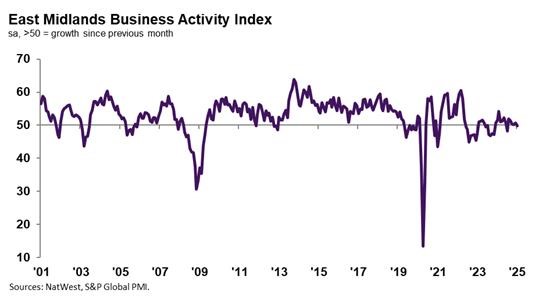

The headline NatWest East Midlands Business Activity Index registered at 49.8 in January, down from 50.7 in December, to signal a renewed fall in output at firms in the region. The decrease in activity was the first seen since July 2024, albeit only fractional overall.

Panellists noted that subdued demand conditions drove the decline, as new orders fell again. Nonetheless, East Midlands firms remained confident of a rise in output over the next year.

Average cost burdens faced by firms increased at a sharper pace in the opening month of 2025. Higher input prices were linked to greater wage bills and increased energy tariffs.

In a bid to protect margins, East Midlands firms raised their selling prices during January. The pace of charge inflation picked up to the fastest since December 2023 and was sharper than the series average. Panellists sought to pass through greater costs to customers.

Lisa Phillips, Regional Managing Director, Midlands and East, Commercial Mid Markets, said: “Whilst the opening month of 2025 saw a challenging demand environment for East Midlands firms, the region started the year in a more stable place than other parts of the country, however.

“Businesses remained upbeat in their outlook for the coming year.

“Encouragingly, firms were able to pass through some of the increase in costs to their customers, via higher selling prices. Inflationary pressures were strong, but nonetheless, input price and output charge hikes in the region were less marked than at the UK level.

“The Bank of England’s interest rate cut last week means that policy is now less restrictive, with further loosening expected in the year ahead.”

Performance in relation to UK

The fall in output at firms in the East Midlands was only fractional, but contrasted with a marginal increase in activity seen at the UK level. Panellists noted that subdued demand conditions drove the decline, as new orders fell again, and at the fastest pace since June 2024.

Lower new orders were often attributed to weak customer confidence amid challenging economic conditions, and the resulting efforts by clients to reduce costs. The fall in new orders was stronger than the UK average, meanwhile.

Nevertheless, businesses were positive in their expectations regarding the outlook for output over the coming year in January. Optimism among companies reportedly stemmed from new product development, investment in new facilities and hopes of stronger demand conditions. That said, the degree of confidence slipped from that seen in December.

Of the 12 monitored UK areas, only the West Midlands and London were more upbeat regarding their prospects.

Meanwhile, anecdotal evidence suggested that lower employment was due to reduced new order inflows and cut-backs to temporary and part-time workers. The rate of contraction was strong and the second-fastest since September 2023. The pace of decline was broadly in line with the UK average, however.

At the same time, companies in the East Midlands depleted their backlogs of work at the weakest rate in three months at the start of the year. Panellists stated that subdued demand conditions enabled them to work through incomplete business. Although sharper than the long-run series average, the pace of decline was slower than the UK average.

Cost burdens rose at a quicker pace in January. The rate of input cost inflation was historically elevated and the fastest since April 2024, albeit just below the UK average.

Subsequently, firms raised their output charges in January, although the rate of increase in selling prices was slightly less marked than the UK average.