Just one month to go until the Property & Business Investment Lincolnshire Expo!

Growth capital investor experiences record levels of investment activity in the East Midlands

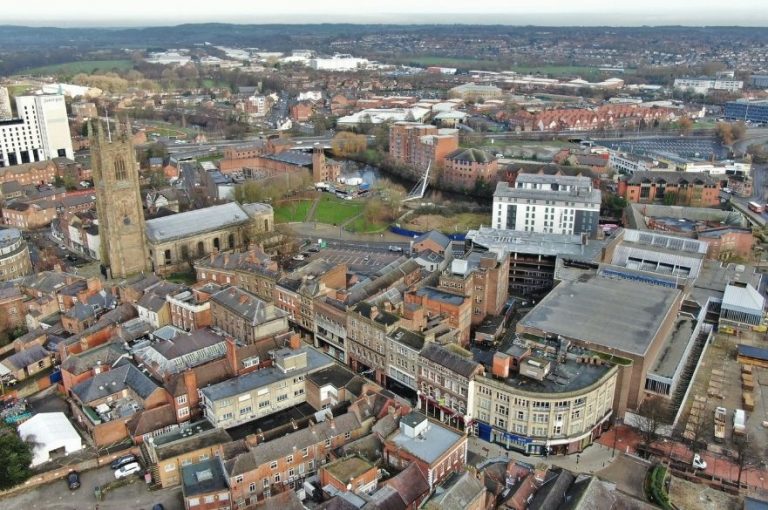

Planning application submitted for cost-saving and green-friendly council office move

Council leaders bid for combined devolution deal for more funding and new local power

ESRC invests £1.6m of £11m fund in Derby study to tackle productivity puzzle

Hot Topic – Yael Selfin, Chief Economist at KPMG UK responds to chancellors spring statement

Business Link chats with Yael Selfin, Chief Economist at KPMG UK on the Chancellors Spring Statement.

“The Chancellor is relying on OBR forecasts that were relatively optimistic on economic growth from next year, with the risk of further escalation of the conflict between Russia and Ukraine lowering growth in 2022 too. This would make it trickier for the Chancellor to meet his fiscal target, and leaves limited room for further incentives for business investment and innovation – now expected in the Autumn Budget.

“The new OBR projections show that the Chancellor is still on track to meet his fiscal mandate in 2024-25 by a £27.8bn margin. Given the rolling nature of the targets, the Chancellor could still find the wiggle room to reduce the tax-to-GDP ratio ahead of the 2024 general election, as the target year is pushed back. However, this is still dependent on the economic outlook.

“Today’s tax cut announcements, however, including on the basic rate of income tax, do little to alleviate the rise in the tax-to-GDP ratio. The tax take is now projected to reach an eye-watering 36.3% of GDP, its highest level since the late 1940s.

“While faster growth since October has boosted public finances, a sharp deterioration in the economic outlook means that more spending is now needed to help households with rising living costs, alongside measures to support small businesses. This pushes up projected net borrowing in the current fiscal year by an extra £16bn.

“Limited additional help was offered to shelter households facing rising home energy prices, with the increase in the National Insurance threshold acting to offset some of the additional costs to working families.

“The reduction in the income tax rate was the Chancellor’s big surprise. While it will please voters ahead of the election, it will not help solve the country’s failing productivity performance. We will need to wait for the Autumn Budget to see what the Chancellor has in store for that.”

7 tips for successful information security management

Streets Chartered Accountants breaks down the Spring Statement 2022

Lincolnshire’s £1.7m drive to fund filling job vacancies

Greater Lincolnshire LEP is launching a call for innovative projects to support jobs and the region’s labour market by offering funding worth a total of £1.7m

- Training, eg for specific occupations such as Large Goods Vehicle Training (LGV) or training that is more flexible than other funds allow

- Labour market attraction schemes, e.g. face-to-face jobs fairs, industry tasters, job related campaigns

- Specialist support for people out of work (over and above what is already available through Government funding and European Social Fund schemes)

- Specialist recruitment and retention support

- Purchase of equipment/capital investment/new technologies, eg to resolve requirement to labour-intensive roles

- Support to fill roles that have been continuously challenging to fill

- Other innovative or collaborative schemes, eg transport schemes, sustainable childcare schemes

- Consideration of the impact of Covid – how do we enable people to return to work ensuring that any mental health needs are addressed?

- Rural dimension is very important – are there technology interventions in social care that could be considered? Care, visitor economy and hospitality sectors are losing large numbers of staff to other sectors; what opportunities are there to rebalance this beyond offering higher salaries?

- Innovative schemes/structured approaches to help address vacancies in the interim, given that automation and planning for the future take time, eg food sector, loss of seasonal EU staff

- Ideas that help address retention of skills in key sectors, eg in the construction and manufacturing sector; many are picking and choosing their jobs in other regions (attraction of larger projects, higher salaries, etc)

- Initiatives such as wheels to work, bespoke demand-responsive transport options, understanding the seclusion of many of our rural communities

- Innovative ideas that might help attract back recently retired individuals, garnering knowledge and expertise

- Wage incentives will not be eligible

- Schemes must not duplicate something already funded or readily available and accessible

- We are seeking schemes that are innovative and/or collaborative

- All projects must address labour shortages in the immediate or short term and focus on solutions that reduce the need for labour or fill job vacancies

- Schemes that will not result in addressing labour shortages by March 2026 will not be considered

- Where the proposal is for a capital asset, or for funds to train your own staff or recruit staff for your own business, match funding will be required

- Schemes that deliver training must result in people moving into job roles that would otherwise not have been filled within 60 days of the end of the intervention

- All project proposals must state clearly how outputs or outcomes will be measured and reported

- There is a maximum of £1.7m available in this scheme

- Scheme proposals can be capital or revenue or a combination of both

- Funding requests should be in excess of £200,000, although consideration will be given to proposals that seek £100,000 if there is a very strong case

- All funds must be spent by 31st December 2024, and outcomes delivered by 2025