East Midlands economy continues to toughen with hike in demand for insolvency advice

Leicester law firm expands Development team

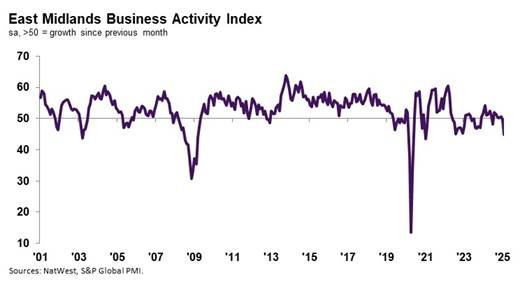

February sees deepening downturn in East Midlands private sector

Alliance Healthcare restructuring puts 490 jobs at risk

Alliance Healthcare plans to close two distribution centres and downsize a third, placing up to 490 jobs at risk. The company intends to shut sites in Nottingham and Hinckley while cutting 110 roles at its South Normanton facility. Operations will be consolidated into a new logistics hub in Birmingham, set to open in 2026.

The restructuring is part of an effort to modernise distribution, as some existing sites are considered outdated and costly to upgrade. The Usdaw trade union, representing workers at the Nottingham site, has confirmed consultations will begin soon to assess the impact and challenge the business case.

UK insolvency activity surges while business start-ups stall

Insolvency-related activity across the UK rose sharply in February, with Yorkshire and the Humber recording a 39% increase, according to data from R3, the UK’s insolvency and restructuring trade body. The East Midlands (79%) and South West (77%) saw the most significant jumps, while Northern Ireland was the only region to see a decline (-38%).

The data from Creditsafe, includes liquidator and administrator appointments and creditors’ meetings. Meanwhile, new business start-ups remained stagnant, rising just 0.2% in Yorkshire and the Humber—the only English region to see growth. Scotland recorded the highest start-up increase at 9%, while Northern Ireland and Wales also saw slight gains.

Quickline launches career portal to boost job skills in Yorkshire and Lincolnshire

Quickline has introduced a virtual work experience portal to help young people and job seekers in Yorkshire and Lincolnshire explore career paths and develop essential skills. Created in partnership with Engaging Education, the free platform provides industry insights in engineering, HR, marketing, and data analysis.

The initiative, launched during National Careers Week (3-8 March), is designed for students aged 13 to 19 and is also available to job seekers aged 19+ in South Yorkshire through job centres and community organisations.

The portal features real-world advice from professionals, interactive challenges, and quizzes. It is part of Quickline’s social value commitment under Project Gigabit, the UK government’s programme to expand high-speed broadband in underserved areas.

Government rejects £750m rail freight hub over infrastructure concerns

The UK government has rejected plans for a £750 million rail freight hub in Leicestershire, citing infrastructure and road safety concerns.

Developer Tritax Symmetry proposed the Hinckley National Rail Freight Interchange (HNRFI) on 662 acres of farmland between Hinckley and Leicester, claiming it would create over 8,000 jobs. However, Transport Secretary Heidi Alexander ruled that the project’s potential negative impacts outweighed its benefits.

The decision was based on concerns that increased lorry traffic would overwhelm M69 junctions, pose safety risks in Sapcote, and disrupt local transport with 775-metre-long trains at the Narborough level crossing. Leicestershire County Council and local MPs, who opposed the project, welcomed the decision, arguing the plan lacked adequate infrastructure support.

Tritax Symmetry expressed disappointment and is seeking legal advice on potential next steps.

Quartet of approvals for Hockley Developments

Leicester and Derby lead UK cities for commercial property investment

Leicester and Derby have emerged as top UK cities for commercial property investment in 2025, according to a survey by the Alan Boswell Group. The study ranked 31 major cities based on business closure rates, crime levels, retail sales performance, and rateable property values.

Leicester secured the top spot with a score of 7.06/10, benefiting from retail sales reaching 100.3% of 2019 levels and a modest 3.79% increase in rateable value over five years. The city also reported low crime rates, with only six shoplifting cases and around one non-residential burglary per 1,000 businesses, making it an attractive location for investors.

Derby ranked third with a score of 6.99/10, supported by strong retail sales at 102% of 2019 levels and a low non-residential burglary rate of one per 1,000 businesses. The city’s commercial property market appears stable, with a lower level of empty premises relief (£193,291 per 1,000 businesses) compared to Leicester (£261,469 per 1,000 businesses), suggesting higher occupancy rates.

Both cities offer a favourable environment for commercial property investment, with steady demand and low business closure rates contributing to their strong rankings.